apply for benefits like SSI or Medi-Cal.arrange the distribution of retirement benefits.make bank deposits, withdrawals or other transactions.Here are examples of tasks you can have your agent do: Or, your Power of Attorney can authorize your agent to handle on-going tasks. For example, your agent can sign sale documents or contracts for the purchase of a house, or to sell your car. The person you appoint to represent you is called the agent or attorney-in-fact.Ī Power of Attorney lets you authorize someone to handle a specific task, like signing documents for you while you are away. If you sign a Power of Attorney, you are the principal. For healthcare POAs, be sure to give a copy to your healthcare provider.Ĭompleting a POA gives you the peace of mind that someone can handle things for you if you are unable to do so.A Power of Attorney is a document that lets you appoint someone to represent you. If you are a nursing home resident, the form must also be witnessed by a patient advocate or ombudsman in addition to your two witnesses.Īs soon as you sign the POA form, it is in force. The witnesses cannot be your agent, your healthcare provider, or an employee of your healthcare provider. The principal and two witnesses must sign a healthcare POA. The agent listed in the POA cannot be a witness to the document. If the POA gives your agent the right to handle real estate transactions, the document must be notarized so that it can be recorded with your county. A general or limited POA must be signed by the principal and two witnesses or a notary. The principal must also have the legal capacity to enter into a contract.

#Ca financial power of attorney how to#

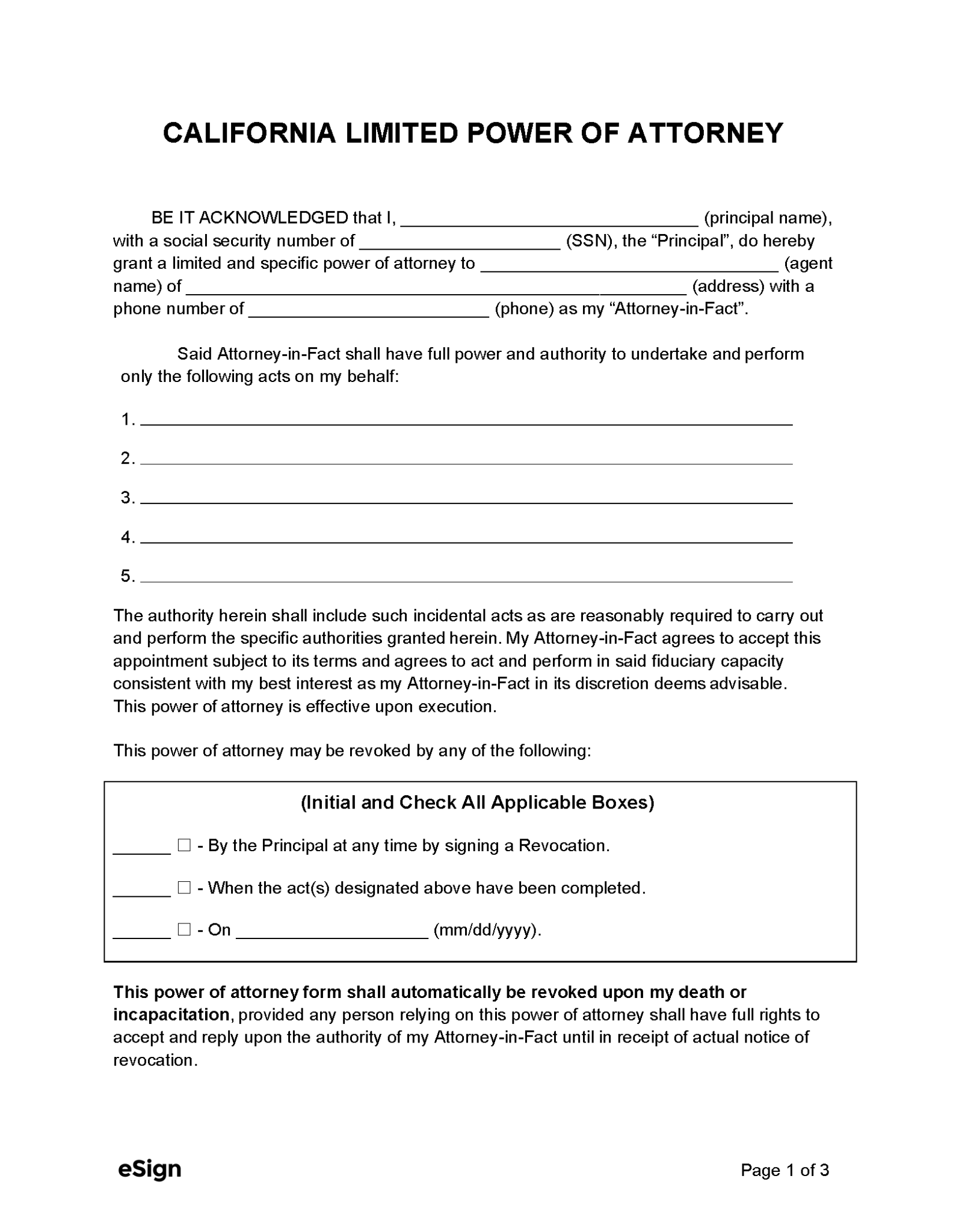

How to execute a California POAĪ California POAcan only be created by a principal who is 18 years of age or older. If you are unsure about which form to use or how to complete and execute it, legal assistance is a good idea. You can also work with an attorney or an online service to create and execute your POA.

#Ca financial power of attorney code#

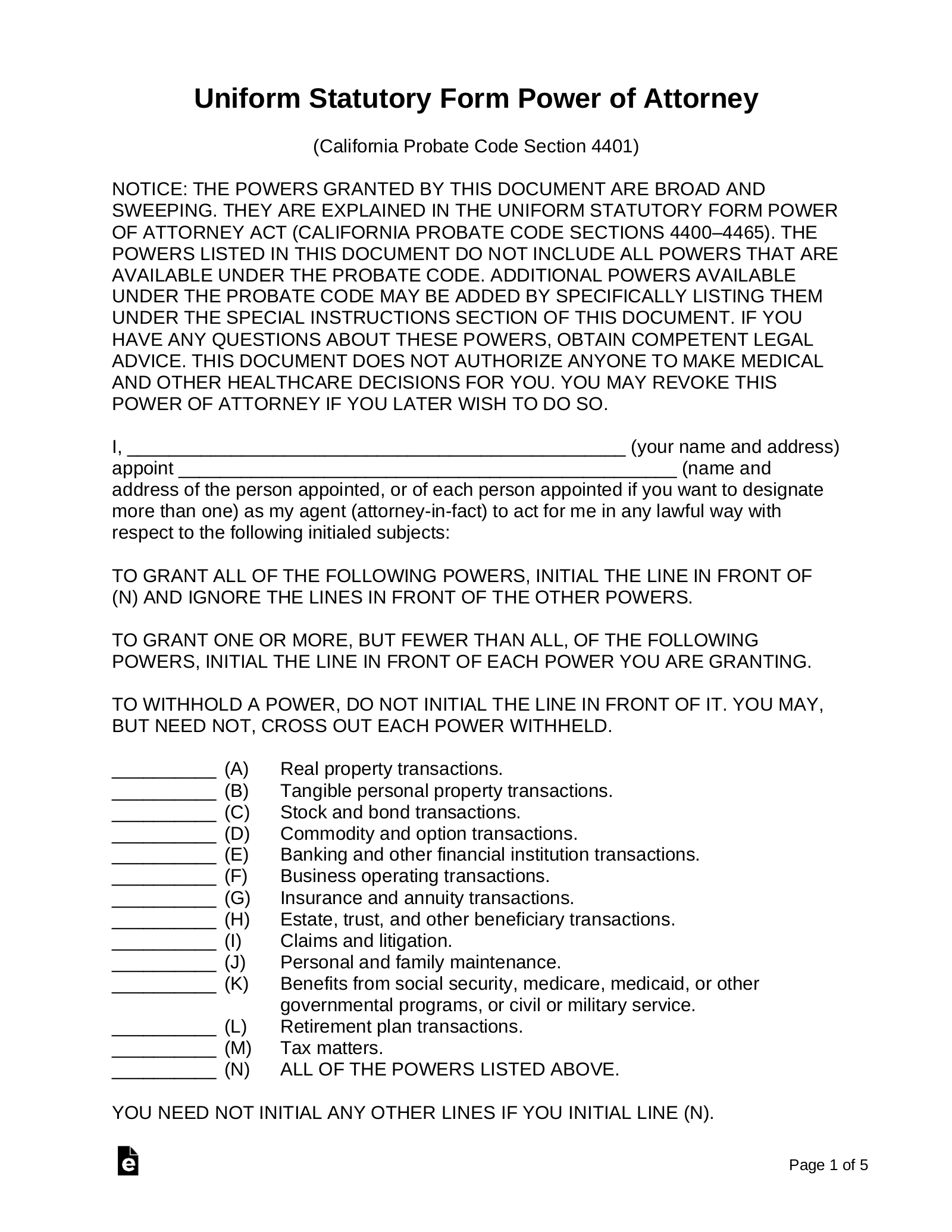

The California healthcare POA is found in Section 4701 of the Probate Code and is called an advanced healthcare directive. This is used to create general or limited POAs. You can find financial POAs in California Probate Code Section 4401, called a Uniform Statutory Form Power of Attorney. In California, you must use the form created by the state for your POA. A healthcare POA is always a springing type since it only goes into effect if you cannot make your own medical decisions.

For example, you could create it so that it takes effect only if you are incapacitated or so that it is effective for one month.

Springing POA. A general or limited POA can be written so that it takes effect only at a certain time or under certain conditions (so it "springs" into action only at that time).Durable POA. A general or limited POA can be durable, which means it goes into effect when you sign it and remains in effect until you destroy or revoke it.In addition to the types of matters the POA covers, when the POA will become effective can also vary. Healthcare POA. Should you become incapacitated, this document gives your agent the right to make healthcare decisions on your behalf.You can authorize your agent to handle only that specific real estate transaction for you. For example, you may be planning a trip, but your new house's closing is scheduled while you are away. This is a very narrow POA that gives your agent the authority to act for you only in specific situations you list in the document. Limited POA. This is sometimes called a specific POA.

General POA. This is the broadest kind of POA and gives your agent the right to handle a wide variety of financial matters for you.When you create a POA, you are called the principal, and the person you choose to act for you is called your attorney-in-fact or your agent. A power of attorney (POA) gives someone you name the authority to handle legal or financial matters for you under specific circumstances.

0 kommentar(er)

0 kommentar(er)